Firms’ adaptation to climate change: what does a hotter world mean for business?

1. Introduction

Global warming is expected to entail a complex of natural phenomena, including “gradual” changes, such as temperature growth, glacier receding, sea level rise, etc, and “extreme” changes, or natural disasters like floods, hurricanes, epidemics and others (Stern, 2006). Table 1 contains a brief summary of probable meteorological changes and geophysical processes caused by climate change.

Table 1. Natural phenomena caused by climate change

|

Changes |

“Gradual” changes |

“Extreme” changes (disasters) |

|

1. Meteorological changes |

||

|

Temperature |

Average temperature growth |

Heat waves, cold waves |

|

Moisture |

Changes in atmospheric precipitation |

Thunderstorms, hails, droughts |

|

Wind speed |

Changes in wind speed |

Hurricanes, snowstorms, dust storms |

|

2. Affected geophysical processes |

||

|

Lithosphere |

Soil erosion |

Earthquakes, volcanism, landslips |

|

Cryosphere |

Glacier and permafrost receding |

Avalanching |

|

Hydrosphere |

Sea level rise, change in ocean currents |

Floods, tsunami |

|

Biosphere |

Size, structure, migration of populations |

Epidemics |

Source: IPCC, 2001; Stern, 2006

To date, the extensive research in economics of climate change is focused on mitigation schemes through greenhouse gas (GHG) emissions reduction and to a lesser degree on adaptation strategies to hotter climate. However, even in optimistic mitigation scenarios the stabilization levels of GHG concentrations will be higher than today. In this sense, climate change is inevitable and requires special efforts in adaptation to global warming.

The existing research in adaptation to climate change is concentrated on probability of damage for particular regions or key resources for some sectors of economy (Stern, 2006; Hoffman, 2006), or business awareness of climate induced risks (Firth et al, 2006; CDP Report, 2006). There are attempts to classify risks of climate change and respective vulnerabilities by magnitude, reversibility, confidence, timing, potential of adaptation (Schnellhuber et al, 2006; Klein et al, 2006). The deeper insights into the meaning of “dangerous effects” from the viewpoints of experts and society are available (Dessai et al, 2003). However the businessfocused investigations of climate change impact on cross-industry level are not yet common. Most of existing studies cover single industry risks and solutions (Lloyds, 2006; Hacker et al, 2005) which can be summarized on cross-industry level.

Therefore, the goal of our investigation is to summarize existing research and empiric evidence of industry-specific climate change impact with a focus on firm-level response strategies. Below we classify the climate change impacts on businesses, analyze the selective climate change vulnerabilities in industrial and regional breakdown together with new business opportunities caused by global warming. After that we summarize the company-level response strategies to climate change. The empiric evidence of climate-induced challenges and response strategies include company data of EU, USA, Canada, Japan and Russia.

2. Impacts of Global Warming on Business

We propose to distinguish the expected consequences of climate change for businesses into direct and indirect impact, as it corresponds to the climate adaptation strategies. Direct impact means that business assets, labor and other company production factors (inputs) are affected by long-term meteorological changes and shifts in geophysical processes, either gradual or extreme. Indirect impact reveals itself through demand-side effects on businesses, i.e. originates from company’s customers and represent a shift in demand.

In addition, climate change may produce either general or selective impact on businesses. General impact covers all industries within a certain region and naturally implies environmentcaused changes in labor conditions and energy use. An example of such impact is industrial process interruptions due to high air temperatures, insufficient cooling capability and local electric supply failures, affecting multiple industries. Another example of general impact is the various consequences of natural disasters and economic shocks entailed. In contrast, selective impact affects assets and other production factors and market perspectives of selected climate dependent businesses. For instance, global warming may affect certain assets in agriculture and electric power generation through changing the productivity of crops and hydropotential of water basins. Market prospects for certain products may also be affected through climate-induced changes in consumer behavior. The examples are changes in seasonal pattern of energy consumption, reduction in demand for winter apparel, increase in demand for insurance against climatic risks and so on. Combination of the above mentioned types of climate change impact brings out a simple matrix typology of climate change impact on business (Table 2).

Table 2. Types of climate change impact on business

|

|

Direct impact (business assets and inputs) |

Indirect impact (demand-side effects) |

|

General impact (all industries) |

Changes in labor conditions |

Changes in total productivity of economy |

|

Damage from natural disasters in affected regions |

Economic shocks caused by natural disasters |

|

|

Selective impact (selected industries) |

Assets and inputs of climate dependent industries (agriculture, forestry, tourism, etc) |

Shifts in demand for selected goods and services (electric power, insurance, etc) |

Existing research (Hoffman, 2006; Klein et al, 2006) stress the industrial dimension of climate induced vulnerabilities and unequal adaptability of various industries to climate change. At the same time, most of attention is now paid to the general impact of climate change, with a focus on estimating the expected changes in overall economic performance and possible damage in result of natural disasters. The selective impact of climate change on cross-industry level is less investigated. The existing works (Schnellhuber et al, 2006; Lloyd’s, 2006; Hacker et al, 2005) are focused on certain industries which are highly exposed to climate induced risks – insurance, construction and energy supply.

An important step in understanding of selective climate change impact, either direct or indirect, is provided by Carbon Disclosure project (CDP, 2006; Firth et al, 2006) on company level, including cases in oil and gas production, metallurgy, electricity generation, banking and insurance, etc. We used this information together with companies’ data to summarize the examples of selective vulnerabilities, opportunities and response strategies to climate change on company level.

3. Selective Impact of Climate Change: Key Challenges for Business

Selective impact of climate change produces an industry-specific effect on business assets, other production factors and demand. For business unit, the sensitivity to this kind of climate change impact can be different, depending on assets it employs, goods or services it produces and geographic location it operates. Consequently, the capacity of business unit to adapt to this impact can be also different .

The selective impact of climate change contains 2 major challenges for business. The first is to adjust existing operations and facilities to the new hotter environment, i.e. to respond to the threats of climate change and become less vulnerable to it. The second challenge is to find and employ the new business opportunities arising from the climate change. These opportunities can be in the form of emerging new markets, increase in demand, and new possibilities in exploring natural resources.

To summarize the existing threats and opportunities on cross-industry level, we grouped the information concerning possible business threats and opportunities in accordance with ISIC industry code. The sources of information are company responses to the Carbon Disclosure Project questionnaire and other publicly available company data. The results are presented in Appendices 1 and 2.

About 20 industries (out of 60 groups on the “upper level” of ISIC) can be considered potentially vulnerable to the industry-specific climate change impact. The potential vulnerabilities can be divided into 2 parts – vulnerability of assets and inputs (which represents the direct impact of climate change) and vulnerability from the demand side (i.e. indirect impact of climate change). In short, one can select industries with climate dependent assets, or climatedependent demand, or both.

Business units with the most climate dependent assets are the companies directly exploiting the natural resources. In most cases, they belong to agriculture, forestry and logging, fishing, extraction of crude petroleum and natural gas, mining, hydropower generation and recreational services (tourist resorts). A number of manufacturing businesses might experience the so-called “second-order” climate dependency of assets and inputs due to the buyer-supplier relations with producers of raw materials. The examples of such kind of climate dependency are manufacture of food and beverages, wood, cork and paper products, manufacture of basic metals, machinery and equipment and other goods.

A lot of companies supplying consumer goods and services have climate dependent demand. The most vulnerable in this case might be electricity and water supply, insurance sector, healthcare and social services, construction. In most cases, the climate dependency of demand means it’s restructuring in time (if seasonal pattern of consumption is changed) or in composition of “consumer basket” (some goods are less demanded and the other are more demanded instead).

Division between climate dependent assets and climate dependent demand allows to show the diverse nature of risks involved with climate change. Since a number of industries may experience both kinds of vulnerabilities to climate change, it is important to take into account the various kinds of climate dependency while elaborating the adaptation strategy of a company.

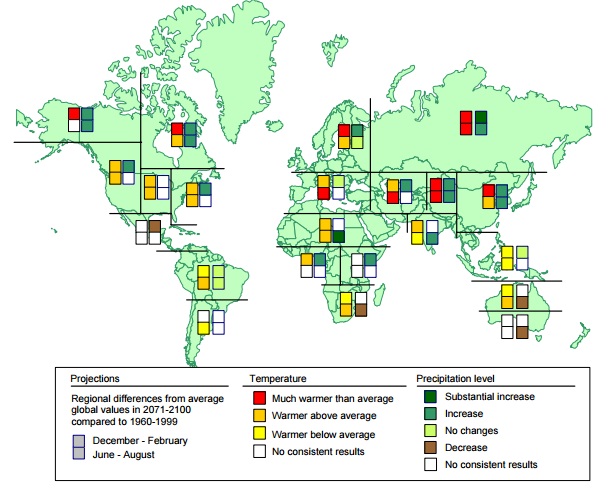

The vulnerability of businesses to climate change also depends on the region they operate. Region specific climate changes are extensively studied by means of sophisticated climatic models (IPCC, 2001; Stern Review, 2006). However, the problem of uncertainty still exists due to lengthy forecast periods, probability of unanticipated climate changes (for instance, reversed ocean currents) and global mitigation efforts. To indicate the potentially problematic regions, we summarize the results of IPCC global long term forecasts of temperature and atmospheric precipitation in 2071-2100 compared to 1961-1990 (IPCC, 2001). In Figure 1, we put together the forecasts corresponding to B2 IPCC scenario.

Figure 1. Global warming in regional dimension (adapted from IPCC, 2001)

The greater climate changes are expected in the region, the more vulnerable the climatedependent businesses of the region can be. Joint picture of regional differences in temperature and precipitation shows that 3 types of locations are potentially more vulnerable: higher latitude or mountainous areas; water stressed territories and low lying coastal zones. This allows to add another dimension to analysis of adaptation strategies on company level. For instance, if business is located in potentially vulnerable regions, adaptation strategies for it may vary from adaptive actions to re-localization of business when possible. Table 4 lists this potentially most vulnerable locations and most affected business assets.

Table 3. Business locations potentially most vulnerable to climate change

|

Location types |

Expected changes |

Examples |

Most affected assets and industries |

|

Higher latitude or mountainous areas |

Much warmer winters, ice melting, water logging |

Northern regions of Russia and Canada, Alaska, Central Asia |

Mining, hydro power generation, all infrastructure assets, tourist resorts |

|

Water stressed territories |

Hotter summers, increased water stress, droughts |

South-East Asia, Australia, Southern Europe, South Africa, Central America |

Agriculture, forestry, water supply, hydro power generation |

|

Low lying coastal zones |

Warmer temperatures, sea level rise, floods |

South Asia, North-West Europe, Pacific islands, Florida |

Agriculture, water supply, fisheries, tourist resort |

Source: Stern, 2006; IPCC, 2001

It is known that climate change potentially brings new business opportunities (Stern, 2006). They originate either from activities in climate change mitigation, or emerging new markets, or in some cases from assets productivity growth due to climate change. To date, the existing research on new climate related opportunities for business is focused on mitigation, including participation in carbon trade, clean development mechanism and joint investment (Hoffman, 2006). However the discussion of business opportunities, arising from global warming itself, is less common.

Using ISIC codes, we summarized the potential business opportunities in a hotter world (Appendix 2). Since we left aside the extensively studied mitigation activities, the remained opportunities can be divided by the origin into assets improvement and demand increase. The improvement of assets is attributable to some business units closely connected with natural resources exploitation. For instance, potentially some new areas may be available or accessible for agricultural, forestry, fishing, mining and other resource extraction activities. The demand increase as potential business opportunity is probable for some manufacturing industries (manufacturers of beverages, wearing apparel, cooling systems) and services (construction, medical services and new forms of insurance). The possibility of new business opportunities indicates that the adaptation strategy for company should address the question if there are any climate-induced opportunities and how to take advantage of them.

4. How to Become Climate-Proof Company?

A climate-proof company is a business unit resistant to climate-induced risks. Becoming climate-proof requires to implement the climatic risk factor and climate-induced business opportunities into the company’s decision making, from elaboration of development strategies to day-to-day routines. In other words, climate-proof company develops adequate response, or adaptation strategy, to the challenges of climate change.

To date, the business response to climate change is diverse, ranging from long-term active adaptation strategies to passive absorption of costs entailed by climate change. Since the challenges imposed by climate change are relatively new for companies, yet few of them can be considered climate-proof. The existing company strategies in response to climate change are focused mostly on medium-term activities corresponding to international mitigation schemes (Hoffman, 2006; CDP Report, 2006), such as emissions reduction and investment to clean development projects. In addition, some companies are elaborating adaptation strategies which include protection of climate dependent assets, possible relocations of business, and taking advantage of new business opportunities resulting from global warming. Due to the uncertainty of scale of expected climate changes and, in particular, the limitations of after-Kyoto period, the planning horizon in many cases is no longer than 5 years (till 2012). However, the need for becoming climate-proof is expected to increase and to cover almost all companies in the world in future, as even in optimistic scenarios the climate change is inevitable (Stern Review, 2006).

A number of companies have already faced the impact of climate change and necessity to adapt to it. There is a growing amount of adaptation attempts, connected with both the general impact and selective impact of climate change. To date, the majority of such examples correspond to the most vulnerable companies, which possess climate-dependent assets, operate on the market with climate-dependent demand and located in the so-called “hotspots” of expected climate changes, including coastal zones, water stressed regions, high latitude and mountainous areas. These businesses are the first to encounter impacts of climate change. The adaptation experience of these companies is useful for the rest of the business units with similar assets, demand and locations. These examples also demonstrate the passive and active ways of adaptation on a company level.

We summarize the existing examples of company adaptation to various impacts of climate change on the basis of Carbon Disclosure Project Questionnaire (CDP Report, 2006) and other publicly available data on European, US, Japanese and Russian companies and industries (Appendix 3). The examples are grouped by industry in accordance with ISIC codes.

The cross-industry adaptation examples clearly demonstrate the diversity of ways to become climate-proof company. Logically, an adaptation strategy of a company depends on the source of climate-induced vulnerability – assets, demand, and location. It also depends on the kind of climate change impact, whether it is general (covering all industries in the location) or selective (covering certain industries or companies).

The adaptation actions of companies range from climate controlling inside the production facilities and labor adjustments to more specific actions as improvement of particular assets and accommodating to demand shifts. Table 4 links the impacts of climate change with applicable adaptation actions which are now employed in business practice.

Table 4. Directions of adaptation to climate change on company level

|

|

Climate change impact |

Adaptation actions of companie |

|

General impact (all industries) |

Direct impact (assets and inputs) |

|

|

|

|

|

Indirect impact (demand-side effects) |

||

|

|

|

|

Selective impact (selected industries) |

Direct impact (assets and inputs) |

|

|

|

|

|

Indirect impact (demand-side effects) |

||

|

|

|

Table 4 shows that selective impact of climate change is most difficult to adapt to. In fact, the industries with climate-dependent assets or climate-dependent demand face double challenge. First, they have either to protect and improve their assets or to adjust to demand shifts. Second, they are also vulnerable to the risks of general impact of climate change, like all other industries. That is why the task of becoming climate-proof for companies exposed to selective climate change usually requires greater efforts and entails higher costs. Probably this is one of the reasons why a number of companies vulnerable to selective impact of climate change, yet prefer passive adaptation strategies, such as closing or reducing the production volumes and adsorbing the other costs of climate change. In view of long term business development, more active adaptation approach is required. One of the ways to stimulate the active response to climate change on company level is to encourage the innovations of companies enabling them to become climate proof.

Conclusions

To date, the impact of climate change and opportunities for adaptation to it vary across companies. Climate change can influence companies directly, through their assets and inputs, or indirectly, through the shifts in demand. It also can be general, i.e. influence all the companies within a specific location, or specific, i.e. affect certain industries. The vulnerability of a business 9 unit to all these kinds of climate change impact depends on assets it employs, goods or services it produces and geographic location it operates.

The most vulnerable to climate change are businesses with climate-dependent assets or climate-dependent demand, which are located in higher latitude or mountainous areas, water stressed territories, and low lying coastal zones. These companies are at higher risks of climate change and potentially are the first to experience the necessity of adaptation to climate change. The existing examples of companies’ adaptation to climate change correspond mostly to such companies. The number of companies experiencing the need for adaptation strategies is expected to grow in the near future.

To become climate-proof, the companies need to implement the climatic risk factor and climate-induced business opportunities into the company’s decision making, from elaboration of development strategies to day-to-day routines. The existing experience of adaptation to climate change demonstrates a variety of actions ranging from climate controlling inside the production facilities and labor adjustments to more specific actions as improvement of particular assets and accommodating to demand shifts. Since the challenges imposed by climate change are relatively new for companies, yet few of them can be considered climate-proof. To stimulate this process, it is advised to encourage the innovations of companies enabling them to develop adequate adaptation strategy to the challenges of climate change.

References

The Economics of Climate Change. The Stern Review. Nicholas Stern. Cabinet Office – HM Treasury, 2006, UK.

Climate Change 2007: the Physical Science Basis. Ed. By S. Solomon, D. Oin, M. Manning et al. Contribution of Working Group I to the Fourth Assessment Report of theIntergovernmental Panel on Climate Change. IPCC

Climate Change 2001: Synthesis Report. A Contribution of Working Groups I, II, and III to the Third Assessment Report of the Intergovernmental Panel on Climate Change [Watson, R.T. and the Core Writing Team (eds.)]. Cambridge University Press, Cambridge, United Kingdom, and New York, NY, USA, 398 pp.

Hoffman A. J. Getting Ahead of the Curve: Corporate Strategies That Address Climate Change. The University of Michigan, 2006

Schnellhuber H. J. – Ed. In Chief, Cramer W., Nakicenovic N., Wigley T., Yohe G. – Eds. Avoiding dangerous Climate Change. Cambridge University Press, 2006

Klein R.J.T., Alam M., Burton I., Dougherty W.W., Ebi K.L., Fernandes M. et al. Application of environmentally sound technologies for adaptation to climate change. UNFCCC Technical paper, FCCC/TP/2006/2

Dessai S., Adger W. N., Hulme M., Turnpenny J., Kohler J., Warren R., Defining and Experiencing Dangerous Climate Change. Climatic Change 64: 11–25, 2004

Firth J., Colley M. The Adaptation Tipping Point: Are UK Businesses Climate Proof? Acclimatise and UKCIP, Oxford, 2006.

Climate Change: Adapt of Bust. 360 Risks Project. Lloyd’s, 2006

Hacker J., Belcher S., Connell R. Beating the heat: keeping UK buildings cool in a warming climate. UKCIP, 2005.

A Changing Climate for Business. Project Proposal. UK Climate Impacts Programme (UKCIP), 2007.

Carbon Disclosure Project Report 2006. Innovest, 2006.